Last updated

- March 18, 2022

- 8:48 am

Share this article:

Investment with the right strategy can generate a good return. As quoted by Albert Einstein, compounding interest is the eighth wonder of the world. He who understands it earns it; he who doesn’t pay it. Learning how to leverage the compounding of interest can be very effective to create wealth.

Whtat Is Compound Interest

Compound interest is the interest you earn on your interest. This interest on interest will make a sum grow at a faster rate than simple interest, which is calculated only on the principal amount.

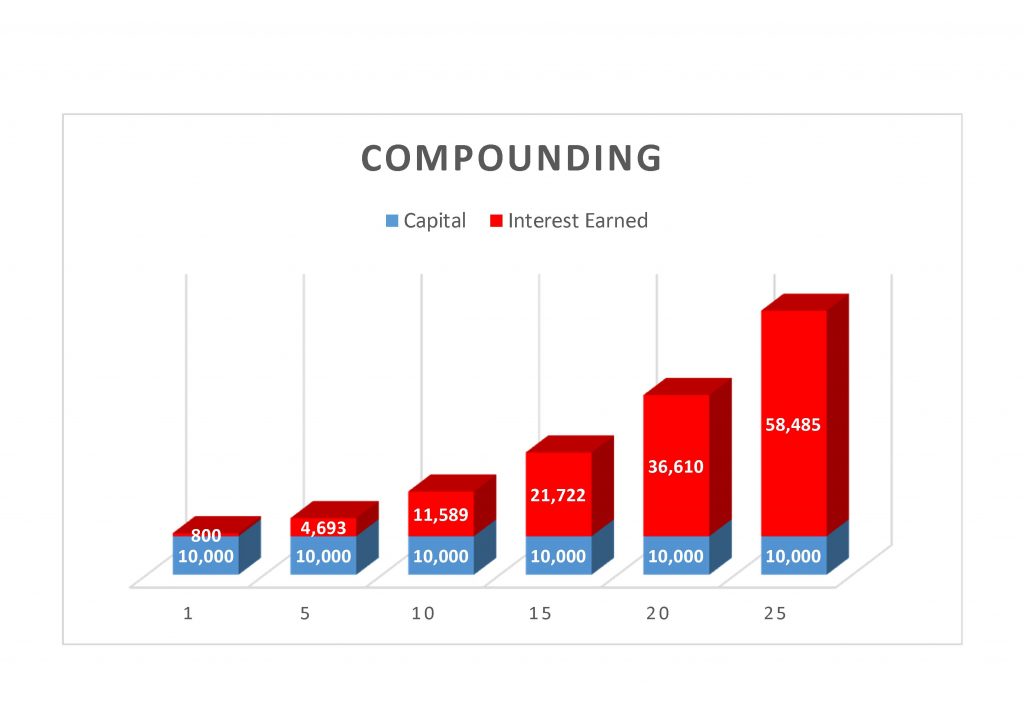

For example, if we invest RM10,000 at an interest rate of 8% per annum (p.a.), we will earn RM800 in interest. That works out to be RM10,800 as your net worth after your first year.

Investing back the RM800 will earn you another RM64 in the second year. This additional RM64 that we earn in the second year is due to the effect of compounding interest. At the same time, the principle of the RM10,000 will still be generating RM800 for the second year.

That works out total interest earned for the second year is RM864 (RM64 + RM800). The total net worth of the second year will become RM11,664 (RM10,800 first-year net worth + RM864 second year interest earned)

Compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn’t pay it.

If we want to earn a greater return with a small amount of capital, we need to allocate more time to the investment. The longer the investment period, the greater the compounding effect is going to be.

If we invest RM10,000 with an assumption of a return of 8% p.a., we will get only RM800 return on investment for a year investment. If we extend our investment interval to 15 years, we will get total interest earned RM21,722. If we extend further to 25 years of investment interval, we will get the interest earned of RM58,485.

This chart shows us how important we need to allocate time for our investment. The more time we allocate for the investment, the more we will benefit from the compounding effect.

Conslusion

It is not how much capital we allocate into the investment count. It is how much time we allocate for our investment to grow. The more time we allocate for it, the more the compounding effect it will be.

Therefore it is important we need to start our investment as earlier as possible to leverage the compounding effect.

Share this article:

Related Articles

9 Common Type Of Risks

Every investment carries risk, including unit trust funds. Here are nine type of common risk that can affect the funds you select.

3 Factors Make Stock Prices Go Up

Understand the 3 important factors that move stocks price up over long period of time allow investors to have more confidence on investing in stocks or equities. Investors no longer worry short term stock price fluctuation and in fact short term market fall create opportunities to invest for batter return in long term.

What Is Unit Trust

A unit trust is a collective investment instrument that allows investors with a similar investment objective to pool their money into a fund.

Subscribe to get the latest articles in future